Tactical Strategy: A Large Directional 200-300 SPX Point Move in U.S. Markets is Potentially Brewing In Coming Weeks

Objective Technical Analysis & Key Levels Strategy on Critical Leading U.S. & China Sectors and Themes (Thoughtful Preview Provided)

Note: This is an intermittent update outside of my usual Bi-Weekly updates. It is much more concise, and informal given time constraints. Thoughtful preview is provided here to hint my sentiment.

Members,

It’s been a chaotic week in the markets, the economy, and global affairs.

As a result, I wanted to increase the frequency of my personal assessment of markets in the form of a journal to share with you, which I hope will assist you with your planning.

Folks know that my style of writing is understandable by anybody - you don’t need a heavy finance background to benefit from my work - all you need is an open mind.

Even if you don’t have much knowledge in investments, the context that I provide will help build your skills over time. All you need to do of course is learn little by little, one day at a time.

Before we get started, given the extreme volatility in markets and my intention to help the good folks, I’m linking a few posts here that will have its paywall removed for the next couple days so that we can see some of the opinions discussed recently.

We saw tactical action take place in the China internet sector at the region where I defended the region as well as a brief opportunistic bounce in key banking names. Examples include Baidu and BABA staging nice bounces from their local lows.

We also saw a market characterized by choppiness post FOMC as I believed out of the possible market structures (upward trending, downward trending, mean-reverting) that mean-reverting (translation: directionless, choppy) would most likely be the market structure in the immediate term.

However, I do not believe this narrow range will be in fashion for long and a breakout direction will soon be in formation. I think a larger directional move will come in the upcoming weeks.

This note will be centered around a few topics:

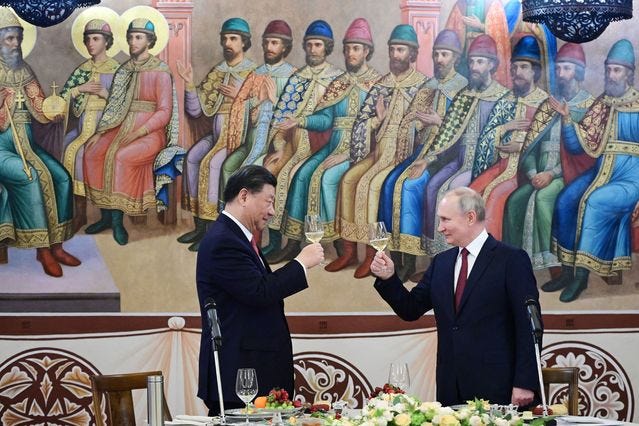

Geopolitics: The evolving relationship between China, Russia, and the U.S. and the geopolitical implications there regarding the China Internet Sector and key names like BABA, BIDU, KWEB, and so forth. We’ll discuss how Tik Tok is related to the discussion surrounding Semis and China stocks.

Key Zones on U.S. Indices: Zones that I believe where risk/reward starts to become attractive for 1.) tactical purchases and 2.) long-term accumulation

Key Zones on market sectors and themes: Zones on inter-market sectors and themes to inform Investors’ opinions on broader market sentiment (Financials, Consumers, China, Semiconductors, Real Estate, Energy)

Long-time members may have noticed that I now heavily employ thoughtfully planned technical analysis in conjunction with the fundamental/macro overlay to find both tactical and long-term opportunities. My fundamental/macro analysis can be found in my early 2023 letters - these updated technical notes are in conjunction with those views.

In such an extremely volatile market, I believe the importance of common-sense technical analysis is critical to putting the big picture in context with fundamentals and macro analysis.

This new updated style is working very well for us for the most part, and in this note, I will highlight zones and regions for key sectors that will clearly show where risk/reward is favorable (and where it isn’t).