Hey Folks -

Above the paywall in this note, I will share my trading Journal (also posted on Instagram here) for today. The purpose of me participating in different timeframes is the following:

Intraday: Generate cash flow (if able) from capturing a piece of Daily Fluctuations in ES (S&P 500 proxy) and NQ (Nasdaq-100 proxy) via Options and Futures

Intermediate-Term: Attempting to find alpha through Themes & Cycles.

Long-Term: Extremely Long Time Horizon. Passive, Compound It, Grow Wealth with Time. Focusing on SPY/QQQ and Blue Chip stocks because these ETFs win long-term.

Any profits from Intraday allow me to re-risk them on ideas I like and also add to my pot of long-term SPY/QQQ holdings. With LT, I keep it simple. I primarily focus on the index funds. The key is how to constantly get more capital to keep adding to them. The way I do it is thru Intraday/Intermediate-Term activities. This is how my 3 timeframes are linked.

Beneath the paywall, I will share META’s DCF Conclusions. By knowing the multiple scenarios from which Mag7 can trade, we are much better equipped to understand how high the S&P 500 and Nasdaq-100 can go.

Today’s Journal

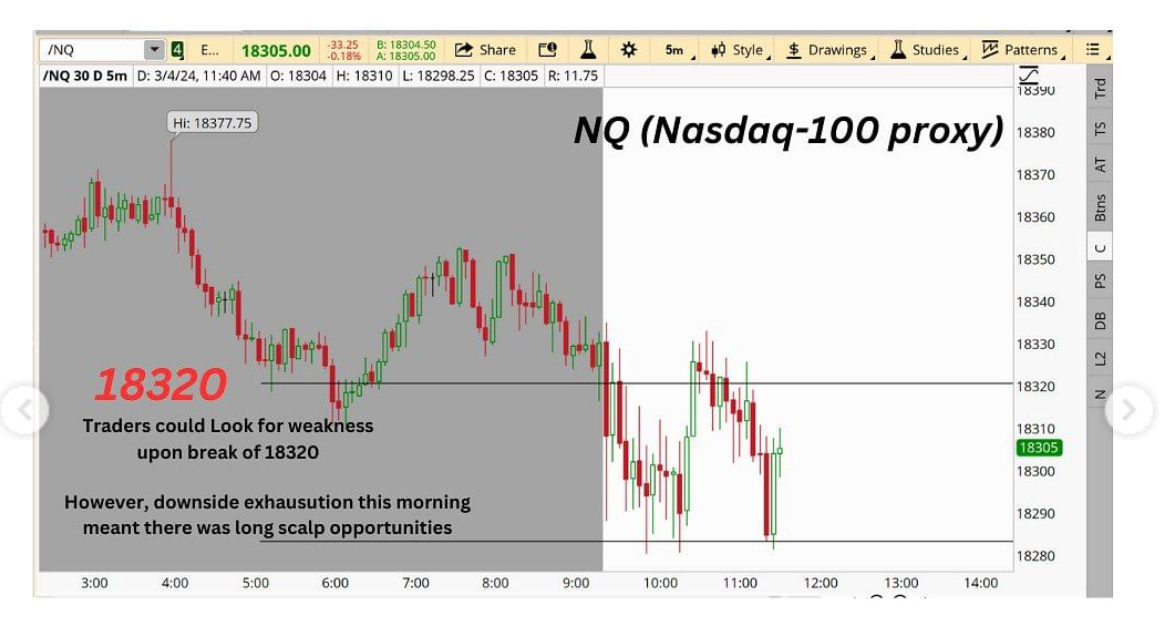

In our pre-market note today, I found an area of vulnerability in NQ (Nasdaq-100 Proxy) if it were to reach that region and shared my thinking with the folks. That level, in my opinion, was 18320 for the NQ. I only participated in the morning session and did not do anything in the afternoon.

For me personally, I targeted weakness in the morning beneath this level with short-sales on micro-NQ in the 18330-340 region and covered most by 18290-300. On intraday downside moves, given that we are in a bullish market, I only look for 30-50 points of downside.

Upon seeing downside exhaustion as we got close to 10am as 18250 wasn’t tested in the morning session, I began layering in some long exposure. Selling exhaustion then turned into a 30-50 point bounce for NQ and at that point I set Stops to protect profits.

By 11am I had met my personal quota and was done for the day.

I didn’t participate in the afternoon. There may be a notion that Intraday Trading is super active. Not really - much of our work in this timeframe is sitting & waiting. I form a plan, and only if I see levels I planned out, I take it and then let risk management play its role. If there’s no clear setup, I am sidelined.

My goal is to capture a piece of the daily action.

And then reinvest Intraday profits (if any) into longer-term positioning.

Now let’s talk about Meta DCF Conclusions below.

Because at certain prices, META could be a very compelling intermediate-term/long-term addition.